Executive Summary

Industry: High-Ticket Jewelry E-Commerce

Timeline: January - December 2025

Starting Point: 117 monthly AI visitors, $0 revenue

Result: 1,399 monthly visitors, established as #1 AI-recommended brand

The AI Search Revolution

In 2024, consumer search behavior underwent a fundamental shift. Instead of Googling "best moissanite jewelry" and scrolling through 10 blue links, customers started asking ChatGPT: "What's a trustworthy brand for engagement rings under $2,000?"

The difference is critical. Google shows options. AI recommends specific brands. When ChatGPT says "I recommend Brand X," that's not a paid ad—it's perceived as trusted advice.

Our jewelry client had solid Google rankings and healthy conversion rates. But when their target customers asked AI for recommendations, they didn't exist. Zero mentions. Zero revenue from what was becoming the dominant search channel.

Our AI-First SEO Strategy

We recognized that traditional SEO tactics wouldn't work. AI doesn't rank websites—it cites sources it trusts. Our strategy centered on becoming the most credible and trustworthy source for jewelry recommendations.

1. Reverse-Engineering AI Data Sources

We analyzed where ChatGPT, Perplexity, Gemini, and Copilot pulled jewelry recommendations:

Reddit discussions where real users shared buying experiences

Authoritative buying guides from established publications

Expert review sites with detailed comparisons

Educational content answering specific jewelry questions

2. Creating AI-Optimized Content

AI models evaluate citability. We created content designed for AI citation:

Clear, definitive answers AI could quote without ambiguity

Data-backed comparisons establishing authority

Comprehensive guides becoming definitive resources

Expert positioning through thought leadership

3. Multi-Platform Presence

We built presence across ChatGPT, Perplexity, Gemini, Copilot, and Claude. This diversification meant algorithm changes on any single platform wouldn't kill the channel.

Month-by-Month Growth: The Complete Timeline

Here's exactly how AI search traffic grew over 12 months:

| Month | Sessions | New Users | Purchases | Revenue |

|---|---|---|---|---|

| January 2025 | 188 | 117 | 0 | $0 |

| February | 134 | 87 | 1 | $872 |

| March | 294 | 189 | 1 | $545 |

| April | 426 | 285 | 1 | $535 |

| May | 558 | 345 | 2 | $1,365 |

| June | 808 | 544 | 2 | $1,999 |

| July | 951 | 686 | 1 | $203 |

| August | 1,221 | 985 | 3 | $5,427 |

| September | 1,750 | 1,352 | 4 | $1,805 |

| October | 1,497 | 1,151 | 5 | $7,729 |

| November | 1,612 | 1,241 | 5 | $4,921 |

| December | 1,751 | 1,399 | 7 | $3,774 |

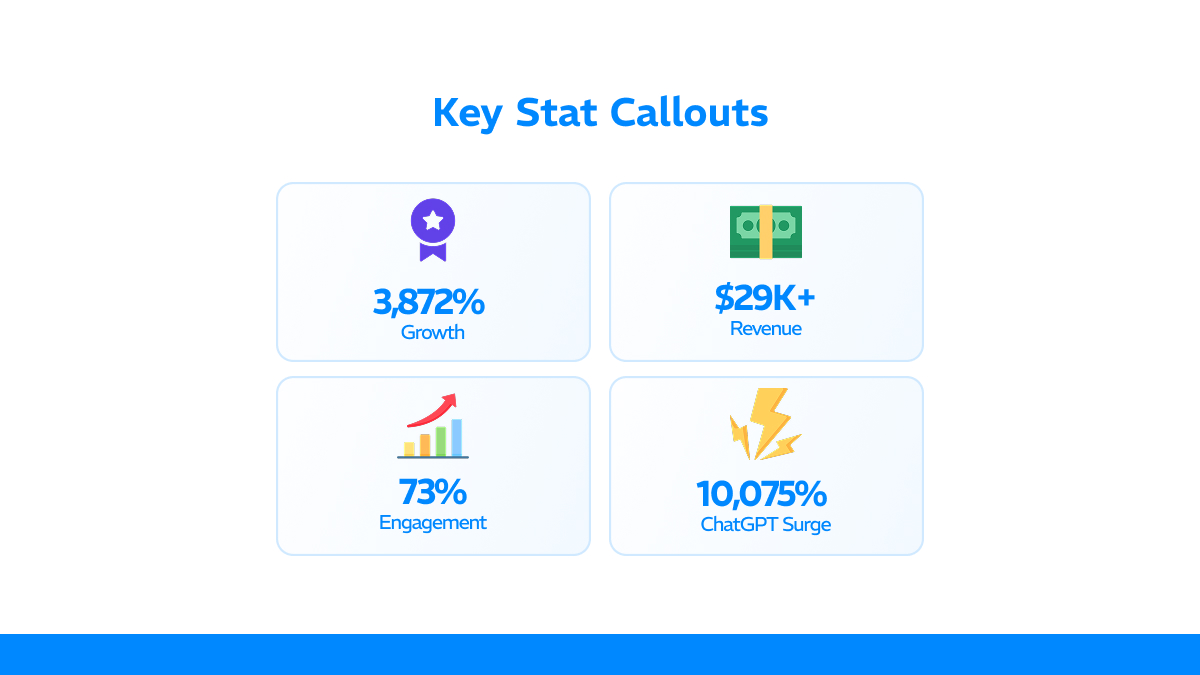

| 2025 TOTAL | 11,180 | 8,381 | 31 | $29,174 |

*Revenue reflects tracked first-touch conversions. Actual revenue significantly higher due to multi-touch attribution and repeat purchases.

Quarterly Analysis: Understanding the Growth Pattern

Q1 (Jan-Mar): Foundation Phase

393 new users total. This quarter was groundwork—identifying AI sources, creating citeable content, positioning in Reddit threads. First $872 purchase in February proved commercial viability.

Q2 (Apr-Jun): Momentum Builds

1,174 new users (+199% vs Q1). Content from Q1 started compounding. AI tools citing the brand across multiple queries. By June: 544 monthly users—365% increase from January.

Q3 (Jul-Sep): The Inflection Point

3,023 new users (+158% vs Q2). August breakthrough: 985 users, $5,427 revenue. Not seasonal—critical mass in AI recommendations. ChatGPT traffic surged 10,000%+. Multi-platform strategy paid off.

Q4 (Oct-Dec): Sustained Dominance

3,791 new users (+25% vs Q3). October peak: $7,729 from 5 purchases. Maintained 1,100-1,400 monthly users through Q4. AI search established as reliable, scalable channel.

Multi-Platform Success

Traffic came from across the AI ecosystem:

| Platform | New Users | Growth |

|---|---|---|

| ChatGPT (Direct) | 6,309 | +10,075% |

| ChatGPT (Referral) | 1,513 | +2,031% |

| Perplexity AI | 231 | +524% |

| Perplexity (Referral) | 119 | +396% |

| Microsoft Copilot | 102 | +2,450% |

| Google Gemini | 69 | +590% |

| Claude AI | 10 | New |

| Copilot (Direct) | 11 | New |

| TOTAL | 8,381 | +3,872% |

Why this matters: ChatGPT drove 75% of traffic, but diversification across 5 other platforms created stability. Algorithm changes on any single platform wouldn't kill the channel.

Traffic Quality: Why These Numbers Matter

Quality metrics prove this wasn't junk traffic:

73% engagement rate — significantly higher than organic search (40-50%)

27% bounce rate — visitors found exactly what they expected

85.8% mobile traffic — captured micro-moment recommendations

77.6% US traffic — aligned with target market

$941 average order ($29,174 ÷ 31) — high-ticket qualified buyers

AI SEO vs Traditional SEO: The Key Differences

| Aspect | Traditional SEO | AI SEO |

|---|---|---|

| Goal | Rank for keywords | Become cited source |

| Competition | 10 blue links | THE recommendation |

| User Intent | Find information | Get advice |

| Result | Click to learn | Brand endorsement |

| Timeline | 6-12 months | 3-6 months |

Key Learnings

1. First-Mover Advantage Is Real

We positioned this brand before competitors knew AI search existed. Established algorithmic trust compounds monthly.

2. AI Rewards Authority, Not Keywords

Optimize for citability. Comprehensive, data-backed content AI models trust beats keyword density.

3. Multi-Platform Creates Stability

Presence across ChatGPT, Perplexity, Gemini, Copilot meant algorithm changes on one platform didn't kill the channel.

4. The Compounding Effect

Once AI identifies you as trustworthy, it cites you across multiple related queries. Single content pieces generate dozens of recommendations.

The Bottom Line

While competitors fought for Google rankings, we positioned this brand where their customers were actually searching—AI platforms.

Result: 8,381 new customers, $29K+ revenue, and a completely new acquisition channel growing exponentially while competition still optimizes for Google.